Quality data about companies’ ESG practices is critical for effective investment analysis. The lack of standardization and transparency in ESG reporting and scoring presents major challenges for investors. Third-party ESG data providers play an important role, but there are limitations with this data – especially in terms of differing methodologies that lead to variance in scores – that asset owners should understand.

Moreover, there is a lack of market infrastructure that can give companies insights into how they are evaluated with respect to ESG scoring. To improve the quality of the ESG data we use to make investment decisions for our clients, State Street Global Advisors (SSGA) has built a scoring system that uses data from multiple best-in-class providers, leverages the SASB transparent materiality framework and incorporates our stewardship insights.

Here, we outline the considerations asset owners should incorporate into their evaluation of ESG data providers.

Headwinds to ESG data quality

Quality data is the lifeblood of investment analysis. While ‘quality’ can be defined in several ways, most investors agree that consistency and comparability in the availability of data across companies are essential elements of an effective dataset.

Unfortunately, the current landscape provides headwinds to achieving those elements of quality when it comes to data about a company’s ESG practices. Governments around the world don’t require companies to report on most ESG data so companies are left to determine for themselves which ESG factors are material to their business performance and what information to disclose to investors.

Asset owners and their investment managers seek solutions to the challenges posed by a lack of consistent, comparable and material information. Investors increasingly view material ESG factors as being critical drivers of a company’s ability to generate sustainable long-term performance. In turn, ESG data has increasing importance for investors’ ability to allocate capital in the most effective manner possible.

ESG data providers play an important role in the investment process by gathering and assessing information about companies’ ESG practices and then scoring those companies accordingly. The development of these ratings systems has helped to nurture the growth of ESG investing by giving asset owners and managers an alternative to conducting such extensive diligence themselves.

As of 2016, there are more than 125 ESG data providers, according to the Global Initiative for Sustainability Ratings. These include well-known providers with global coverage such as Bloomberg, FTSE, MSCI, Sustainalytics, Thomson Reuters and Vigeo Eiris, as well as specialized data providers such as S&P’s Trucost (providing carbon and ‘brown revenue’ data), GRESB (sustainability performance in real estate) and ISS (corporate governance, climate-related and responsible investing solutions).

Despite the valuable contributions these data providers have made in advancing ESG investing globally, it’s important for asset owners and managers to understand the inherent limitations of this data, as well as the challenges of relying on any one provider.

Differences in data collection and methodologies

Lack of standardization and transparency in providers’ data collection and scoring methodologies pose key challenges for investors. ESG data providers generally develop their own sourcing, research and scoring methodologies.

As a result, the rating for a single company can vary widely across different providers. We recently conducted research to quantify the degree to which this lack of standardization leads to variance among the ESG scores used by investors.

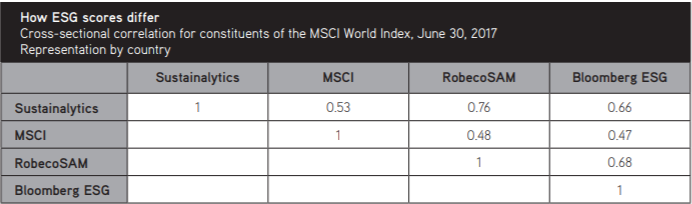

As part of an 18-month due diligence process in which we looked at more than 30 data providers, we examined the cross-sectional correlations for four leading data providers’ ESG scores, using the MSCI World Index as the coverage universe. MSCI and Sustainalytics are two of the most widely used ESG data providers. But, as shown in How ESG scores differ, our research determines a correlation of only 0.53 among their scores, meaning that their ratings of companies are only consistent for about half of the coverage universe.

These differing methodologies have implications for investors. In choosing a particular provider, investors are, in effect, aligning themselves with that particular company’s ESG investment philosophy in terms of data acquisition, materiality, aggregation and weighting. This choice is complicated by the lack of transparency into those methodologies. Most data providers treat their methodologies as proprietary information. By relying on an ESG data provider’s score, therefore, asset owners are taking on the perspectives of that provider without a full understanding of how it arrived at its conclusions.

Assessing the differences

Given the lack of consistency in ESG scores, it’s helpful to understand the factors that are leading to this variance. In our research, three primary points of difference among the methodologies and approaches used by ESG data providers are identified, as follows.

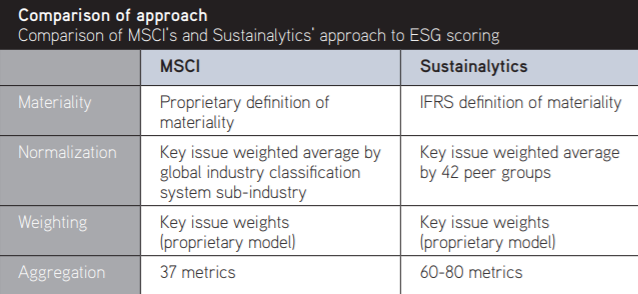

Materiality – A critical part of any ESG scoring is determining which factors are material to a company’s financial performance. As part of the proprietary nature of their solutions, ESG data providers typically make their own determinations on materiality issues – and don’t provide full transparency into how these determinations are made. These differences in how materiality is defined and unveiled add to the difficulty asset owners and managers face in selecting an ESG data provider.

Data acquisition and estimation – We found discernible differences in how ESG data providers source and acquire raw data. In addition to using traditional sourcing techniques to gather data that is disclosed by the company or otherwise publicly available, ESG data providers use statistical models to create estimates for unreported data. These models are based on averages and trends at what the data provider views as similar companies and industry benchmarks. This is an example of how investors are unwittingly incorporating judgment calls by the data provider into their investment decision-making processes.

Aggregation and weighting – Each ESG data provider has developed its own method to aggregate and weight particular ESG factors for its summary scores. Again, these are proprietary judgments made by each individual provider.

ESG scoring at State Street Global Advisors (SSGA)

We believe ESG factors are directly linked to a company’s ability to generate sustainable long-term performance. As fiduciaries, we have a duty to rigorously analyze all financial and non-financial factors that can affect a company’s performance, and we believe ESG factors can be used to mitigate risk and identify potential alpha signals.

To address the gaps in the current market infrastructure, we are building our own scoring system, known as R-Factor. This scoring system will address the data challenges we’ve articulated in these pages. Our approach to ESG data and scoring is guided by three goals:

- To bring greater transparency to the materiality considerations that drive ESG scores

- To develop ESG scores that are based on frameworks supported by a large number of investors

- To promote market infrastructure that both integrates stewardship into ESG scoring and incentivizes greater corporate disclosure of investor-relevant ESG information.

Case study: MSCI versus Sustainalytics

Both MSCI and Sustainalytics are widely used across the asset management industry, and each of them offers global ESG product suites, including ESG ratings and climate-focused products. As Comparison of approach (below) illustrates, however, there are distinct differences in the way the two firms collect and analyze ESG data.

This article appeared in Corporate Secretary’s special report on ESG engagement, reporting and integration